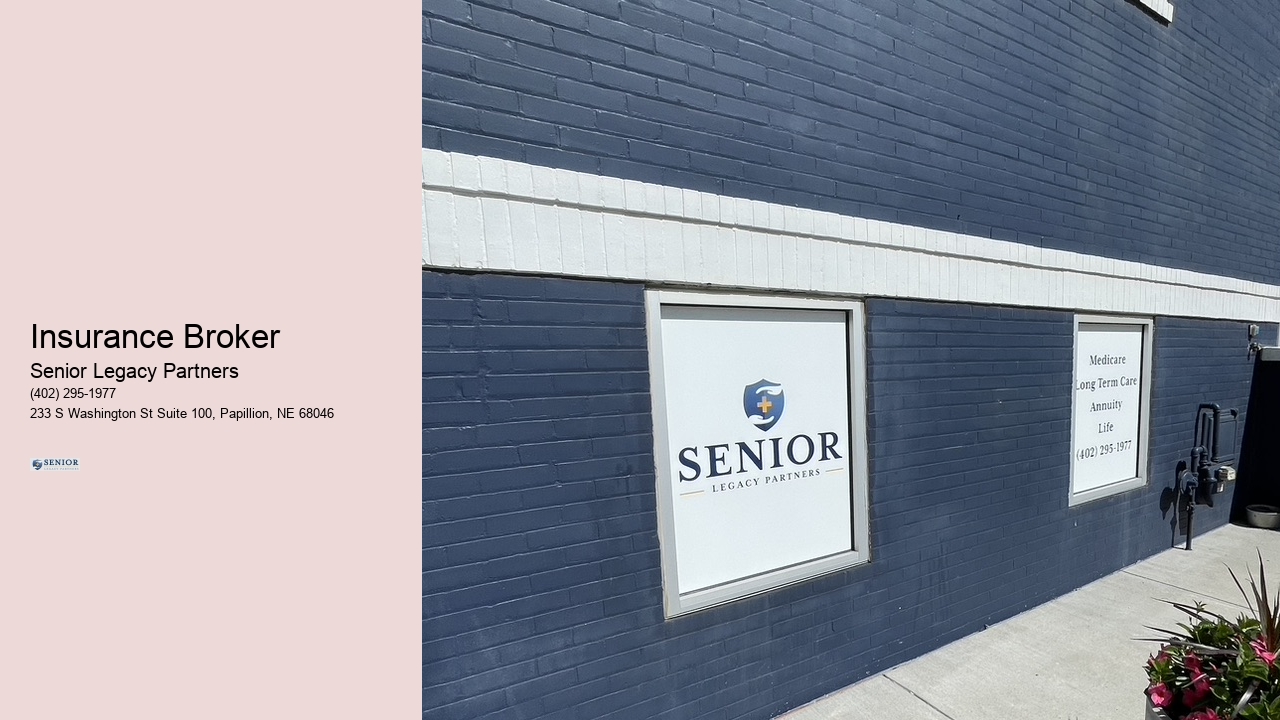

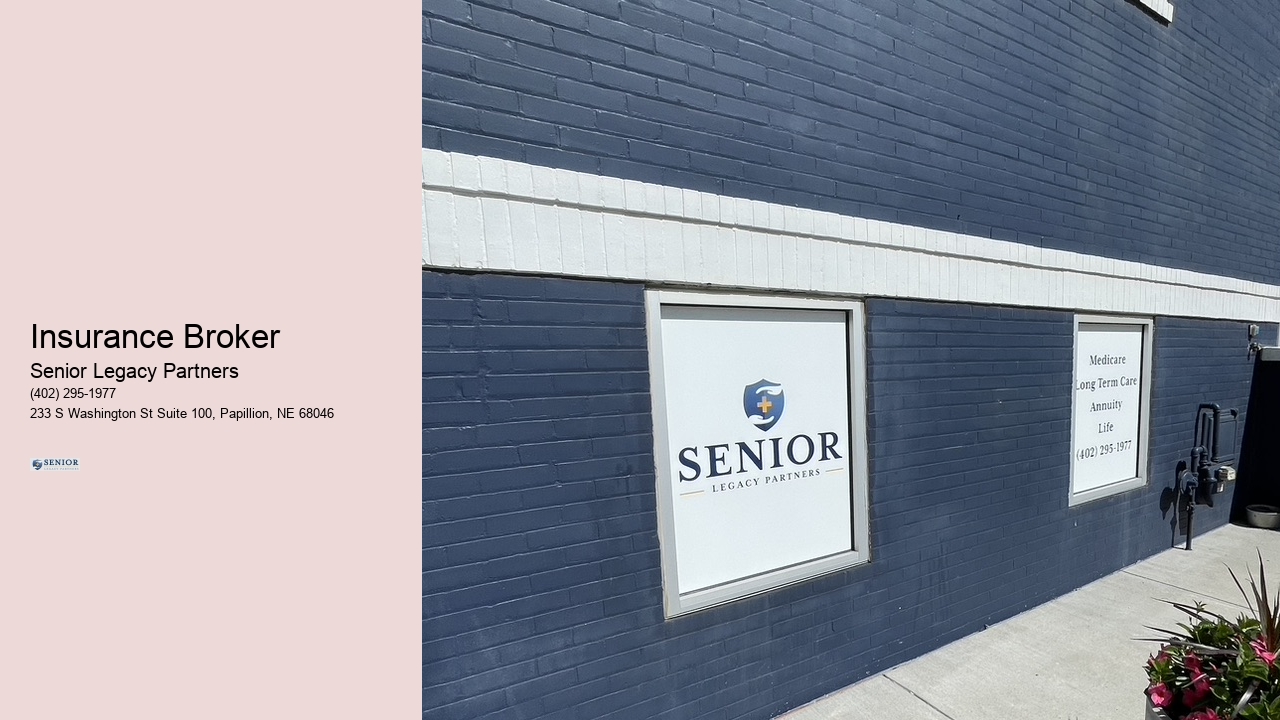

At Senior Legacy Partners, we help you navigate retirement with complete confidence. As an independent brokerage, we address the key challenges of retirement—covering healthcare, long-term care, and legacy planning. trusted Medicare and life insurance broker. Specializing in Medicare Supplement, Medicare Advantage, long-term care coverage, annuities, and life insurance, we ensure these essential aspects are managed with expertise. Our strong partnerships with leading carriers allow us to customize the ideal plan for your needs—whether it's optimizing your Medicare, securing long-term care, or protecting your legacy with the right annuity or life insurance—so your legacy is protected your way!

View Insurance Broker Papillon Nebraska in a full screen map

Service areas: Papillon Nebraska, La Vista Nebraska, Ralston Nebraska, Omaha Nebraska, Council Bluffs Iowa, Glennwood Iowa, Lincoln Nebraska, Sarpy County Nebraska, Cass County Nebraska, Pottawatomie County Iowa, Mills County Iowa, Fremont County Iowa, Page County Iowa

| Life & Long-Term Coverage | |

|---|---|

| Keyword | Description |

| Life Insurance | Policy that provides financial security to loved ones after death. |

| Term Life Insurance | Affordable policy that covers a fixed number of years. |

| Whole Life Insurance | Permanent coverage with both insurance and cash value savings. |

| Final Expense Insurance | Coverage designed to pay funeral and burial costs. |

| Long-Term Care Coverage | Pays for nursing homes, assisted living, and in-home care services. |

| Disability Insurance | Provides income protection if an illness or injury prevents working. |

As you contemplate the future and how to provide for your loved ones, it's vital to consider the role of life insurance in your estate planning. In Papillion, many individuals overlook this essential aspect, yet life insurance is a cornerstone of effective estate management. This article will explore the critical relationship between life insurance and estate planning, emphasizing its importance for residents of Papillion.

Life insurance serves as a safety net, offering financial security when you can’t be there to provide it. Key reasons why incorporating life insurance into your estate planning is essential include:

In Papillion, where the cost of living can be challenging, having life insurance is more than a precaution; it’s a necessity. Here are several vital benefits for residents:

At Senior Legacy Partners, we recognize that every family's needs are unique. That’s why we offer personalized consultations to help you choose the right life insurance policy for your estate planning needs. Our dedicated experts guide you through:

Estate planning laws and regulations vary from state to state, making it essential to work with professionals who are well-versed in local rules. By offering our services in Papillion, we ensure that your estate plan aligns with Illinois laws and regulations. Our local team has experience with clients from various neighborhoods, ensuring they are equipped to meet the needs of the community.

Consider the case of the Johnson family, residents in the Oak Park neighborhood of Papillion. They approached us concerned about their growing debts and the future of their children. After a comprehensive review of their estate plan, we recommended a life insurance policy that would not only cover their debts but also provide sufficient funds for their children’s education. With the right policy in place, the Johnsons gained peace of mind knowing their children’s future was secure, regardless of life’s uncertainties.

Life insurance options such as term life, whole life, and universal life can cater to different estate planning needs. Consultation with an expert can clarify which is right for you.

Life insurance payouts are generally not subject to income tax, which can help minimize the estate tax burden for your beneficiaries.

Yes, many business owners utilize life insurance to ensure their debts are paid, allowing for smooth transitions in business succession.

It’s advisable to review your policy at least annually, especially after significant life events such as marriage, divorce, or the birth of a child.

Life insurance is crucial to ensuring your family’s financial security and peace of mind. At Senior Legacy Partners, we’re committed to helping you navigate the complexities of life insurance as part of your estate planning in Papillion. Contact us today for a free consultation, and let’s ensure your legacy is well-protected.

An insurance agency is a business that employs agents or brokers to sell various insurance policies to individuals and businesses.

Medicare Advantage plans are private insurance options that replace Original Medicare, often including extra benefits like vision or dental.

They offer health insurance plans that cover medical expenses, doctor visits, hospital stays, and other healthcare needs.